×

The Standard e-Paper

Smart Minds Choose Us

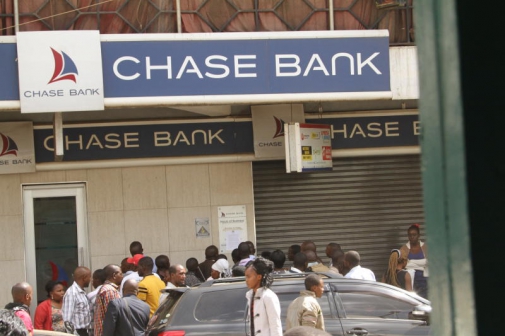

Chase Bank will remain under receivership for about six weeks after a depositor moved to court seeking for an extension. The receivership period was set to lapse on Saturday.

In a matter mentioned yesterday at the High Court in the presence of representatives of the depositor, Kenya Deposit Insurance Corporation (KDIC) and Central Bank of Kenya (CBK), the court said that it will hear the application on November 14.