Kenya: Almost all organisations are vulnerable to workplace fraud regardless of their size. This is evidenced by the number of employees who have been fired or whose cases have been heard in court. It is common to read about cases of employees who have been charged with fraud, pilferage or corruption.

It is a vice employers are trying to fight in order to improve productivity. Fraud can take many forms, including embezzlement, forgery, theft of company assets and computer-based and cyber crime. It can go on for long if unchecked.

The financial impact of such ‘white collar’ crimes to an organisation can be devastating, with experts saying there are two ways of combating such crimes - preventing them or reacting once they have occurred. Generally, most companies choose to stay quiet about the issue, but there was a lot to learn at the East African Breweries Ltd (EABL’s) annual staff compliance and ethics conference held last week.

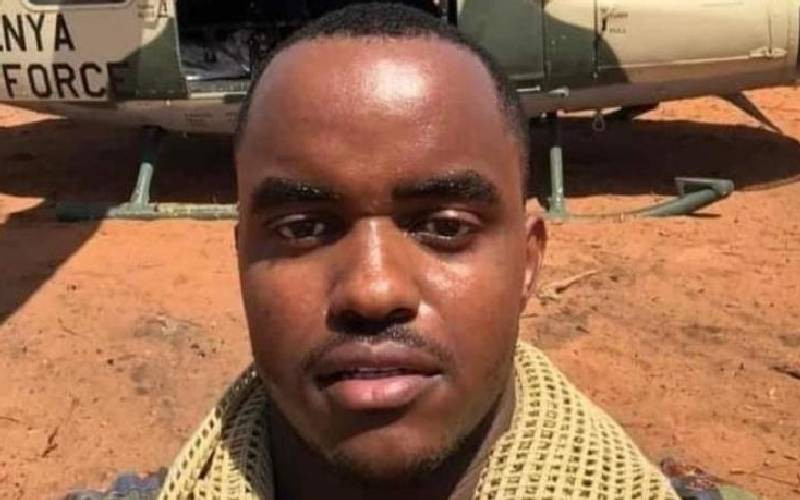

The company invited Olympic gold medallist, Wilfred Bungei, as the guest speaker. It may be difficult to link the workplace with sports or the 800m race in which Bungei excelled as a runner, but by the time Bungei was finishing his talk, the commonalities between sports and the workplace were open for all to see.

Bungei was a middle-distance runner, who won the 800-metre gold medal at the 2008 Olympics in Beijing. He also won the 800-metres title at the World Indoor Championships in Moscow in 2006, defeating Mbulaeni Mulaudzi and Olympic Champion Yuriy Borzakovskiy in the race.

“Cheating or employing fraudulent means for self-satisfaction at the workplace is like doping in sports. It denies the rightful winner his or her place. We should all unite and fight the vice,” said Bungei.

Bungei said organisations must not be complacent about fraud as even petty acts send the wrong message to employees. “I am also in business. What I have learnt is that by turning a blind eye to what is often seen as low-level deception, such as exaggerated mileage claims, some individuals may feel able to rationalise increasingly dishonest and costly behaviour,” said the former athlete.

During a panel discussion that followed, EABL Human Resources Director Paul Kasimu advised firms to have a fraud policy document detailing the company’s definition of what constitutes the practice and the consequences for those who commit the vice. This, he said, leaves no room for misunderstanding.

To institutionalise the fight against fraud and other ills in organisations, such documents are supposed to part of the company’s induction process and should be read by staff on a regular basis. “Explaining the personal and image consequences for the individual, their colleagues and the company will help to establish an anti-fraud culture, again making it harder for fraudsters to rationalise their actions,” advises Kasimu.

A skit by some of the brewer’s employees showed rigorous systems need to be in position to reduce the opportunities that breed or encourage fraud. The systems generally depend on the size and type of organisation. For example, the use of Global Positioning System (GPS) real-time vehicle tracking enables fleet managers at DHL, which transports EABL products, to manage running costs and improve productivity. This is by monitoring vehicle activity and usage.

It also enables them to ensure the accuracy of time-sheets and other expenses. “Having the systems and procedures in place is good but they need to be monitored.

There’s no point having the procedure to discipline the small workers within an organisation, if the supervisor cannot be disciplined and there is proof that their supervisor was also involved,” said DHL Supply Chain Director Thomas Opiyo, who took part in the panel discussion.

Workplace fraud is often seen by those who perpetrate it as a victimless crime, but that is not the case. Stealing from the petty cash may result in a lack of trust towards all employees, leading to poor morale, while exaggerated expenses may mean budget cuts in other areas.

Integrity issues

Fraud can also result in irreparable damage to a company’s reputation, liquidation, the loss of jobs, and unpaid debts to suppliers. Mr Kasimu, who has had vast experience working as HR director at Kenya Airways advises that screening job candidates and employees for their integrity, regularly communicating the company’s fraud policy, and having the systems, checks and balances in place to prevent dishonest behaviour can help guard against fraud.

Stay informed. Subscribe to our newsletter

The skit by the employees suggested there are often “red flags” associated with personal behaviour of perpetrators, such as “wheeler-dealer” attitudes and unwillingness to share responsibilities and living beyond one’s means. It also showed the most common means by which fraud is uncovered is by tips or inside information.

The skit also emphasised the importance of having a whistle-blower system as part of an organisation’s anti-fraud strategy. To be successful, such systems must include elements such as whistle-blower protection, a fraud reporting mechanism and a response mechanism for fraud reports.

The system must be transparent, consistent and trustworthy to ensure its effectiveness.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.