×

The Standard e-Paper

Kenya’s Boldest Voice

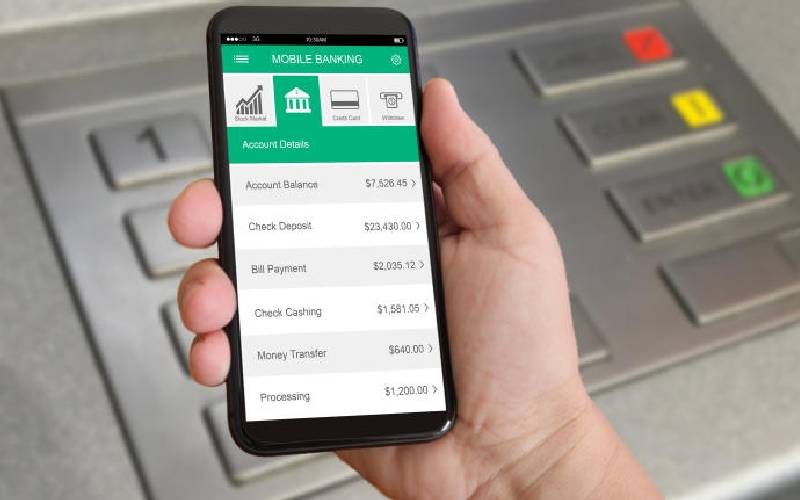

Mobile banking.

If we have learned one thing from the past year, it’s that things can change in a blink — changes that we thought we had years to prepare for, and trends that we expected in the next three to five years have been accelerated by the pandemic.