What a week of contradictions? Exactly how many nations exist in the territory called Kenya? It is practically impossible for a person of sound mind not to wonder what sin we committed as a nation to deserve the calibre of political leaders that we have.

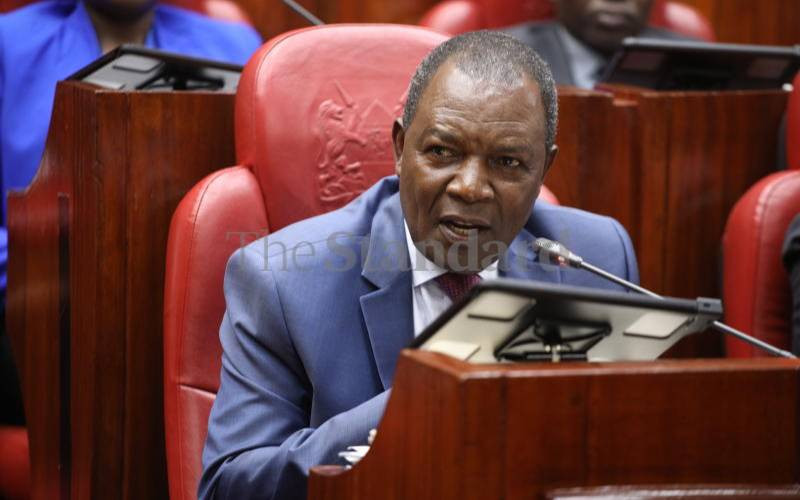

How on earth can a declaration that the country is broke by the Cabinet Secretary in charge of the National Treasury compete for frontline news with proposals to create wasteful State offices that the courts have on various occasions declared unconstitutional? It gets more bizarre when an elected Member of Parliament reasons that such positions will create a taxable income that can salvage the country's cash crunch.