Mention the word ‘police’, and for many people, the picture that comes to mind is that of a law enforcer who can make life difficult for civilians.

Few identify with the daily economic and other struggles that these uniformed men and women go through in the line of duty.

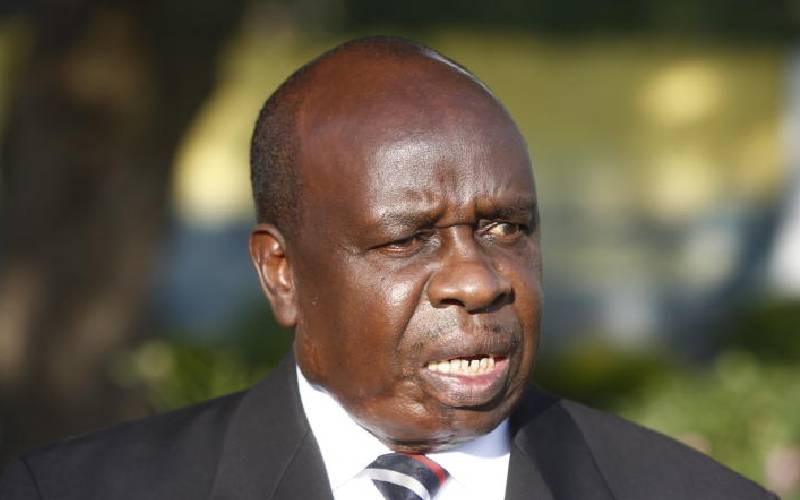

In March last year, however, a parliamentary committee led by Garissa Senator Yusuf Haji exposed the difficult working conditions endured by members of the 107,000-strong disciplined forces, which includes the Kenya Prisons Service.

The revelation led to an uproar, with the public, civil society and some politicians condemning the neglect of the forces.

Mr Haji brought before the National Assembly recommendations on how the National Police Service could be improved. One of the proposals was that the police force get comprehensive medical insurance cover from a robust insurer.

It would be a departure from the National Hospital Insurance Fund (NHIF) scheme, which sees employers make statutory deductions for employees depending on their monthly earnings.

The cracks

A deal was struck, and a Sh18 billion cover was to be provided by a consortium of insurance companies, with AAR being the lead insurer and AON Minet the administrator.

Business Beat has since established that the other insurers in the lucrative contract were Jubilee Insurance and UAP Insurance.

Under the new scheme, the lowest-ranked officer, a constable, was allocated a cover of Sh150,000 for out-patient services, and Sh1.5 million for in-patient care annually.

The highest-ranked officer, on the other hand, got Sh500,000 for out-patient cover and Sh5 million for in-patient care.

But just four months since the implementation of the scheme, cracks have begun to show, with a number of officers expressing their displeasure with the scheme.They say it has become a source of frustration rather than relief for themselves and their families.

One officer attached to a Nairobi station and who requested anonymity to avoid being victimised exemplified this frustration in his narration to Business Beat.

“After getting the new cover, I approached an NHIF-approved hospital for treatment, but I was turned away. They told me I could no longer continue enjoying out-patient services like I used to,” the officer said.

Stay informed. Subscribe to our newsletter

“I was told that before I could get treated, a phone call had to be made to AAR to confirm my new cover. However, I was told I was not in AAR records.”

In response, NHIF Spokesperson Gerald Kainga said despite police officers still making contributions to the fund, some of the benefits the national health insurer used to grant them have been withdrawn

“The National Police Service was covered comprehensively under the Civil Servants and Disciplined Services medical cover until October 2016. This is the time they got an additional cover outside NHIF, which is paid for by the Government,” he said.

“Now our cover with them has changed to the national scheme benefit package. This means that they cannot access such benefits as optical or dental treatment. These were taken over by the new private insurers.”

Another officer stationed in Kiambu County, who also requested anonymity, termed the new Government-funded cover a disappointment.

“My child got sick and I took her to an AAR-approved hospital, but I was told by the doctors that they had to make a phone call to AAR to see if I was covered. I was told that I was in their records, but that my child was not covered. Also, unlike with NHIF, we don’t even have a medical card that we can present to the hospital,” the officer said.

Both officers also claimed no sensitisation was done to bring officers up to speed on the new cover’s operation.

“We just woke up one day and were told of a new scheme which we knew little about,” said one of the officers.

Teething problems

AAR Managing Director Caroline Munene said the partners in the scheme are doing their best to implement the cover, but admits that there are teething problems.

“The three firms carrying out this scheme have similar contracts not only in Kenya, but the entire East African region. The magnitude of effort needed to implement these contracts is huge and that is why the implementation cannot be flawless,” she said.

Ms Munene also admitted that there were information gaps among the police, further complicating the scheme’s administration.

“There are 1,600 health care providers around the country who we have been engaged to provide cover for the police. We provide all in-patient and out-patient services, including foreign treatment for them and their families, but many do not understand the procedures that they have to go through before they access the cover,” she said.

She added that the buck squarely stops with the force to create awareness on what is required to maximise on the scheme’s benefits.

“As a consortium of insurers, we tried to create awareness about the scheme, but clearly, not many officers have been sensitised about it. All I can say is that the scheme is not working flawlessly and we are striving to remove the hurdles, especially the ones the police have pointed out,” Munene said.

AON, the brokerage firm that the AAR consortium contracted to implement the scheme, said it had no knowledge of how the three insurers were administering the scheme on the ground.

“In this whole arrangement, we are like a secretary who mainly sits and takes orders from the boss. We cannot clearly say how the consortium is conducting the scheme,” representatives of AON who did not want to be named said.

Despite the emerging shortcomings in the scheme, the police are upbeat they will soon access medical care that they previously could not.

In addition to in-patient and out-patient services, the scheme covers costs of maternity and oncology, which includes chemotherapy and radiotherapy. Others are dialysis, kidney transplants, specialised services such as CT scans, and dental and optical treatment.

“Right now as we speak, there are police officers who are in Indian hospitals who we are paying for,” Munene said.

[email protected],ke

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.