×

The Standard e-Paper

Smart Minds Choose Us

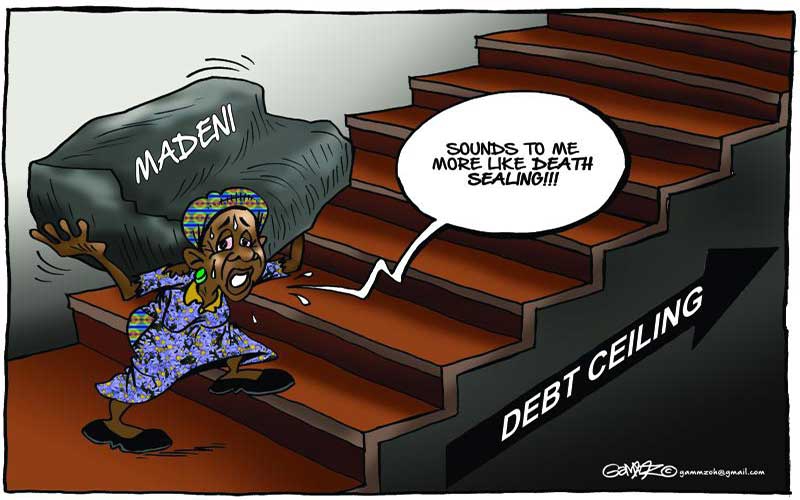

Kenya’s total debt touched Sh6.16 trillion in February after the country borrowed an additional Sh158 billion in two months. As a percentage of the gross domestic product (GDP), or the size of the economy, the country’s debt has since surpassed 60 per cent. This makes our debt unsustainable. We have little leg room for borrowing, thanks to our high appetite that saw the debt levels spiral to the current levels.