×

The Standard e-Paper

Stay Informed, Even Offline

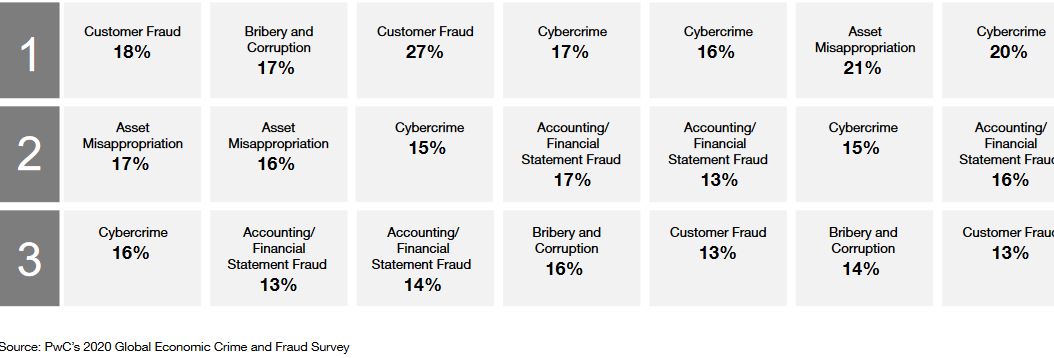

NAIROBI, KENYA: Incidences of fraud are on an upward trend with companies reporting six different types of vice in the last 24 months.

Top perpetrators of fraud are middle management, operations staff, senior management, customer, hackers, and suppliers, the Global Economic Crime and Fraud Survey by pwc reveals.