The planned sale of 15 percent of government-owned shares in Safaricom to the Vodacom group has continued to generate more heat than light, with parliament divided in the center.

The government has termed the deal as too-good-to-be-ignored’ even as some legislators queried the rushed process in offsetting the over 6B shares.

According to Dr. Chris Kiptoo, the PS for National Treasury and Economic Planning, the sale of shares at sh34 per was the best premium pricing in the market and provided value for money.

Kiptoo said the government had negotiated better pricing of the transaction and would help the injection of Sh240B into the budget kitty to fund key infrastructure in the country.

Addressing MPs in Naivasha during the ongoing 2026 Legislative Retreat, the PS said the government was experiencing a shrinking fiscal space, and the sale of the 15 percent would provide a lifeline of extra funding.

The move follows the 2008 Safaricom Initial Public offering where the government reduced its shareholding from 60 percent to 35 percent, with the latest sale set to reduce the shareholding to 20 percent.

Additionally, he said other reforms are being undertaken within state corporations, including mergers, dissolution, and restructuring.

“This is set to be complete by the end of the year and is geared towards improved performance, save budget allocations, and create much-needed fiscal space,” he said.

Consequently, the PS said the ongoing privatisation of government-owned entities, including the market-launched Kenya Pipeline, with the proceeds anchored on the established Nyeri MP Duncan Mathenge Fund that is set to mobilise long-term financial muscle for national projects.

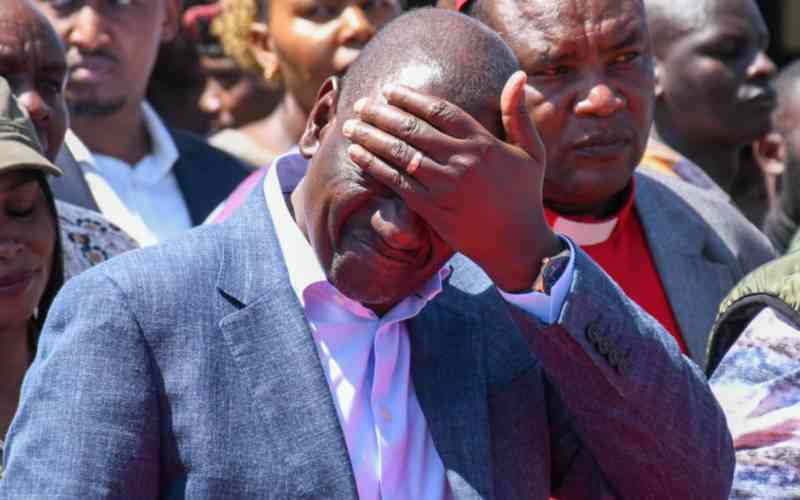

On his part, National Assembly Finance Committee chair Kimani Kuria defended the sale of the government's Safaricom shares, out of the 35 percent owned.

"The government's move to sell 15 percent stake of its shares to Vodacom at sh34 per share will net the government sh244B, which will go to fund key infrastructure owing to limited budget constraints to expenditure", said Kuria.

Kuria said the divestiture of the shares at Safaricom would unlock value, attract investment, and reposition key state assets for long-term national benefit under the tight oversight of parliament.

The Molo MP said Parliament must, at the same time, remain alert to the key risks that require legislative attention and the mechanisms available to manage the risks.

He added that recently, MPs had raised concerns over undervaluation risks of the transaction, corruption, and opaque processes, calling for the need to strengthen oversight frameworks.

The chair said so far, the State has earmarked 18 state-owned enterprises for sale, backed by the Privatisation Act (2025) that calls for transparent transaction structures and strong parliamentary oversight to guarantee prudent use of public resources.

Stay informed. Subscribe to our newsletter

Kimani said the government had already floated the initial for the sale of Kenya Pipeline Corporation, with the initial share offering of sh9 per share in the transaction expected to end by March this year.

However, Karoli Omondi, MP for Subaru South, called for a market survey that provided the best pathway for offsetting the 25 percent shareholding.

Omondi said the government must also consider other alternatives in the market to get the best price, as opposed to exclusively selling the shares to the already existing Vodacom group.

Nyeri MP Duncan Mathenge questioned why the 15 percent government shares had been offered only to Vodacom instead of floating them in the market for any willing investor.

“There are many questions about how the share price was arrived at, why the hurry to dispose of the shares, and how sure are we that the raised cash will go only towards infrastructural projects,” he said.