×

The Standard e-Paper

Home To Bold Columnists

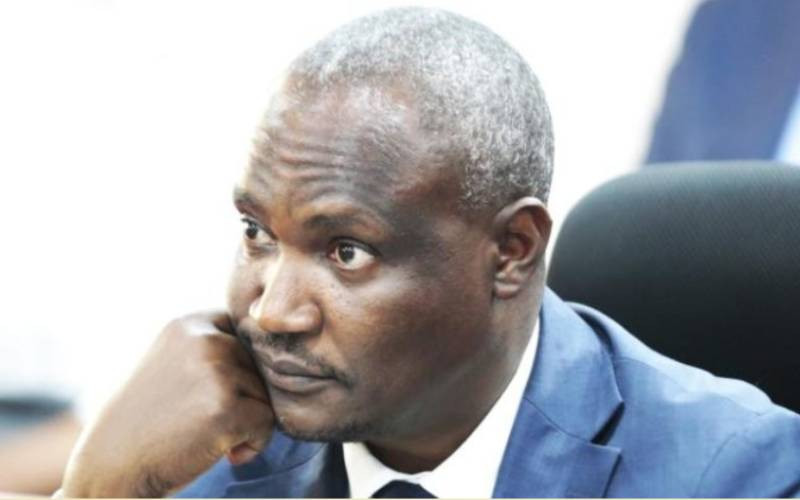

Agricultural Finance Corporation (AFC) Managing Director Lucas Meso during an interview with the Smart Harvest team, Standard, at AFC office, Nairobi. [Jonah Onyango, Standard]

Agricultural Finance Corporation (AFC) has told Bura Irrigation Scheme farmers to visit its offices and agree on how they will pay their loans.