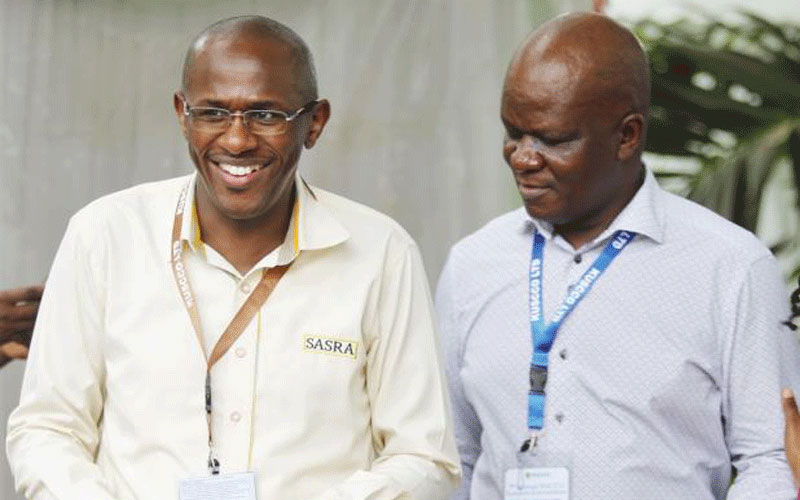

Kenya Union of Savings and Credit Co-operatives CEO George Ototo (right) with Sacco Society Regulatory Authority boss Peter Njuguna in Mombasa yesterday. [Kelvin Karani, Standard]

Get Full Access for Ksh299/Week.