×

The Standard e-Paper

Join Thousands Daily

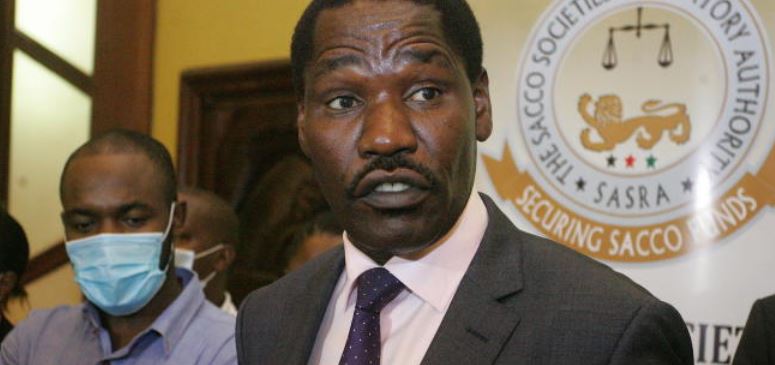

NAIROBI, KENYA: Non-deposit taking Saccos holding deposits worth Sh100 million and above have up to the end of June to apply for an authorisation to operate from the Saccos Societies Regulatory Authority (Sasra).

This follows the publication of the SACCO Societies (Non-deposit taking business) regulations, 2020, which took effect on January 1, 2021.