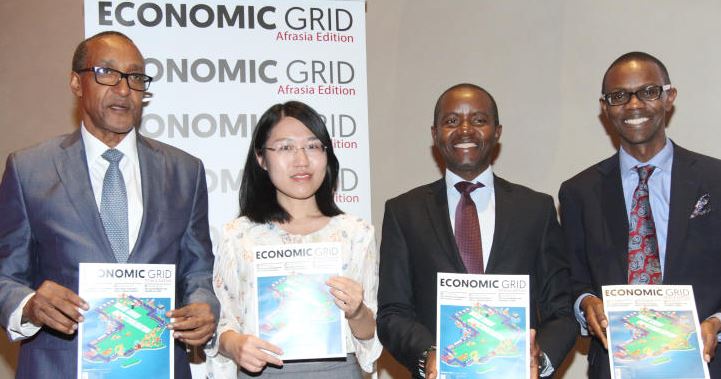

Foreign Affairs PS Ambassador Kamau Macharia (from left) Liu Yue (Chinese Embassy), ICT CS Joe Mucheru and Dr Gilbert Sagia during the launch of teh Econmic Grid at the Aspire Centre ,Westlands, Nairobi. Economic Grid is a global movement that aims to speed up the growth in technological and economic innovations. [Elvis Ogina.Standard]