Serah Mugoi never saw it coming, and she thought it was a slight misunderstanding. She had been a customer care representative at the betting firm, Sportpesa, for almost two years.

“We were in the middle of celebrating a colleague’s birthday when our phones beeped simultaneously. It was an email to all and it changed the mood in the room. The smiles dropped and we stared at each other, desperately trying to come to terms with the sad news,” Ms Mugoi recalls.

On that day in October, Sportpesa let its 362 employees know they were out of a job, just three months to Christmas.

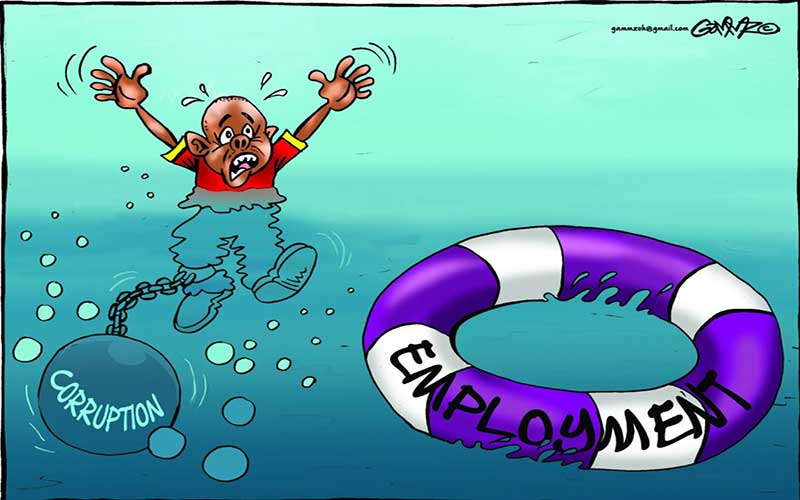

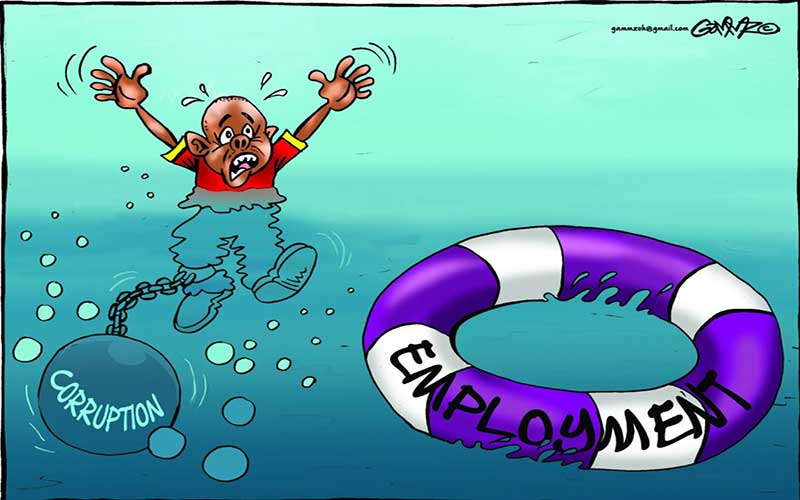

The data may be showing the economy is getting bigger, but for thousands of workers, reality does not reflect this growth.

Scores of employees are headed into a dark festive season, uncertain of whether they will have their jobs come January, as companies embark on a fresh wave of layoffs and cost-cutting measures.

The government too is evaluating ways of bringing down the wage bill as it looks for areas to reduce spending, which has risen to uncontrollable levels.

While it has ruled out retrenchments, the State plans to reduce its wage bill by Sh182 billion through a freeze on employment, a situation creating anxiety among civil servants who are on contract, and fear their terms may not be renewed.

The private sector continues to put jobs on the chopping board, backing a trend seen throughout the year as industry adapts to the realities of an economy that is not showing signs of being on the mend.

Aside from layoffs and doing away with non-essential spending, companies are also dishing out little to no dividends to its shareholders.

On the Nairobi Securities Exchange (NSE), at least 20 listed firms have warned their profits this year will tumble by more than 25 per cent. And just this week, BOC Gas and Eaagads joined the list.

And while the financial sector has seemingly held up the most in the face of a bleeding economy, it has not managed to save all its employees.

Banks have announced round after round of layoffs as technology makes many of its employees redundant. Mobile lender, Tala, joined the fray, with its management announcing impending re-organisation in Kenya just weeks after shutting down Tanzania operations. However, the lender, which has 170 employees in Kenya, said “any departures were done in the course of normal business”.

Staffing levels

In a carefully worded statement, it added: “Tala continuously re-evaluates staffing levels across all markets. “A review of our Kenya business revealed that recent improvements in our technology and product, including automation of some processes, had created additional capacity.”

Stay informed. Subscribe to our newsletter

Troubled airline Silverstone has also declared much of its workforce redundant, issuing a one-month redundancy notice to pilots and crew members. Its fleet was grounded after the Kenya Civil Aviation Authority (KCAA) suspended its Dash-8 fleet to allow for an investigation after a series of mishaps.

But while the regulator earlier this week lifted the suspension, the firm is yet to retract the notice sent out to a majority of its employees.

On Wednesday, the firm said it would evaluate the options that it has in the face of eroded confidence among its clients, adding that it had not received official communication from KCAA.

“Silverstone Air Services Ltd has become redundant. This decision has been made as a result of the recent decision by KCAA to ground the company’s fleet, thereby grounding our passenger services,” said the notice to pilots.

The low-cost carrier said the grounding had negatively impacted its brand and it could, therefore, not continue to operate commercially.

It has been refunding money to the tune of Sh7 million a day over the last week to passengers that had booked and paid.

And at Kenya Power, while it has not laid off staff, it has moved to cut costs, including getting rid of afternoon tea and minimising travel by employees to just what is critical to operations. Internal communication from the power distributor’s new boss, Bernard Ngugi, said costs associated with overtime and travel had reached “unsustainable levels, ultimately affecting our bottom line and threatening the sustainability of the business.” On Monday, the private sector held talks with State officials who put Interior Cabinet Secretary Fred Matiang’i to task over the gloomy business environment.

Companies have been complaining of a liquidity crisis, which is partly attributed to the billions of shillings owed to them by the government.

Businesses are owed more than Sh137 billion, despite a presidential directive in June to clear the bills. On Tuesday, the Treasury even blacklisted some counties for being serial defaulters.

Richard Ngatia, the president of the Kenya National Chamber of Commerce and Industry, told the Sunday Standard that the current cash crunch being witnessed has been occasioned by a number of internal and external factors, including global trade uncertainties. He said to resuscitate the economy, pending bills should be paid to inject cash flow.

“Economic recession is a realistic phenomenon in every economy,” he said.

Other firms that have sent workers home recently include East African Portland Cement Company, East African Breweries Ltd, Telkom Kenya, Securex, Stanbic Bank, Betin, Sanlam Kenya and Ola Energy.

Others are cutting costs to stay afloat, but in the process setting off a chain reaction. Safaricom, for instance, has been looking at ways to reduce its operational costs.

The company, which is the most profitable in the region, has been reviewing its terms of engagement with its suppliers and in many instances reduced the amount paid to contractors while demanding more value for their money.

This has resulted in some of its suppliers scaling down on their personnel, such as guards.

Pending bills and cost-cutting have hit also the media industry hard.

Private sector firms and the government have substantially reduced advertising, with the industry citing a harsh environment where their revenues are not guaranteed, including from the government.

The State has been a stable client, but it is now reducing its spending, delaying payments and instituting austerity measures that touch on the sector.

This has resulted in media houses laying off staff, with the latest being Radio Africa, whose stable include The Star newspaper, Classic FM and Kiss FM. The media house recently announced plans to declare some employees redundant.

Mediamax, whose stable includes K24 and the People Daily newspaper, also laid off about 160 people, while State broadcaster KBC, whose financial woes are affecting its ability to pay salaries, was last week given a notice by employees who plan to lay down their tools come December.

The government’s austerity measures include plans to slash recurrent and development spending by Sh1.49 billion and Sh1.4 billion, respectively.

Its plans to reduce the wage bill, however, have been met with hostility from Cotu. The umbrella body for workers’ unions said the government should quit thinking in “that direction as it cannot be an option”. However, Trade CS Peter Munya, speaking to the media at a recent trade conference, downplayed reports of a harsh operating environment for businesses.

[Wainana Wambu, Macharia Kamau, Kenyanitto Oyier]

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.