×

The Standard e-Paper

Smart Minds Choose Us

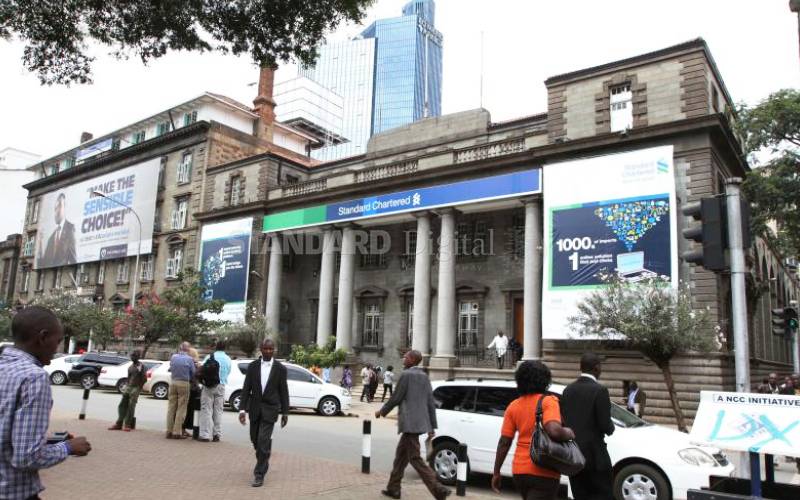

Standard Chartered Bank (StanChart) Kenya has posted a five per cent increase in profit after tax for the first half of 2019 on the back of reduced operating expenses.