×

The Standard e-Paper

Stay Informed, Even Offline

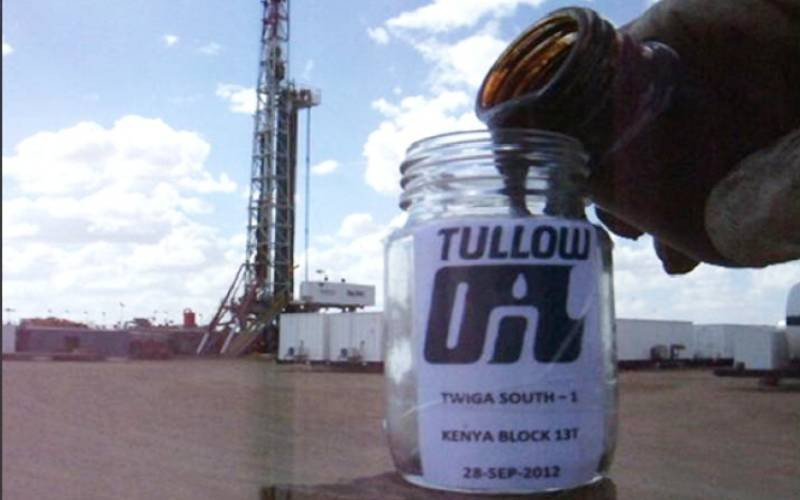

Kenya's oil export dream suffered another major setback yesterday after French giant TotalEnergies and Canada-based exploration company Africa Oil Corp abandoned the much-delayed Turkana oil project.