×

The Standard e-Paper

Smart Minds Choose Us

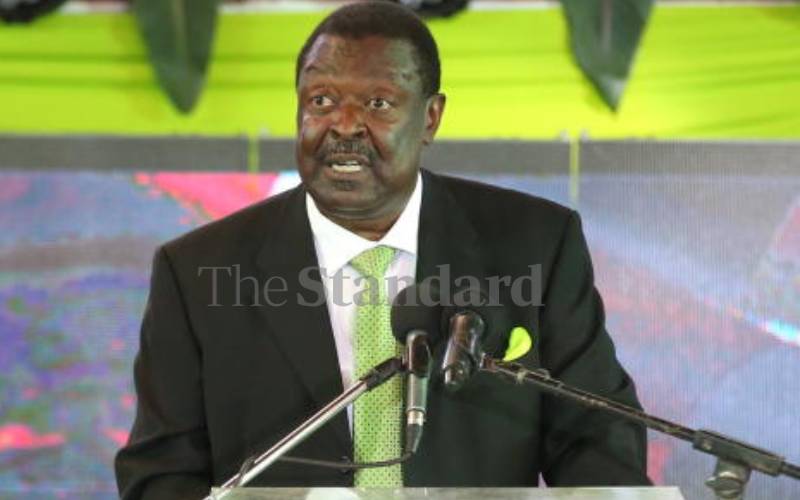

ANC leader Musalia Mudavadi during the party's National Delegates Conference (NDC) at Bomas, Nairobi. January 23, 2022. [Elvis Ogina, Standard]

On 23 January 2022, opposition politician Musalia Mudavadi accepted his party’s nomination for the Kenyan presidency.