×

The Standard e-Paper

Fearless, Trusted News

NAIROBI, KENYA: The Kenyan banks are likely to issue a statement next week on the Thursday decision by the high court to declare interest rate cap unconstitutional.

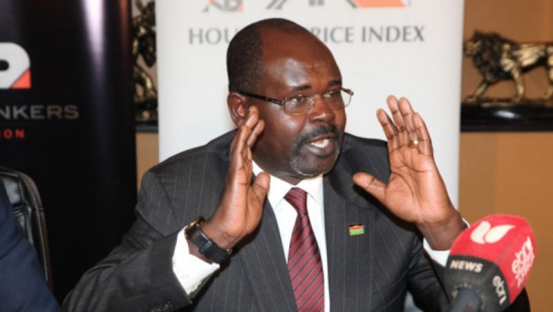

The Kenya Bankers Association Chief Executive Officer Habil Olaka said the body would only comment after a full decision is released by the court next week.