×

The Standard e-Paper

Stay Informed, Even Offline

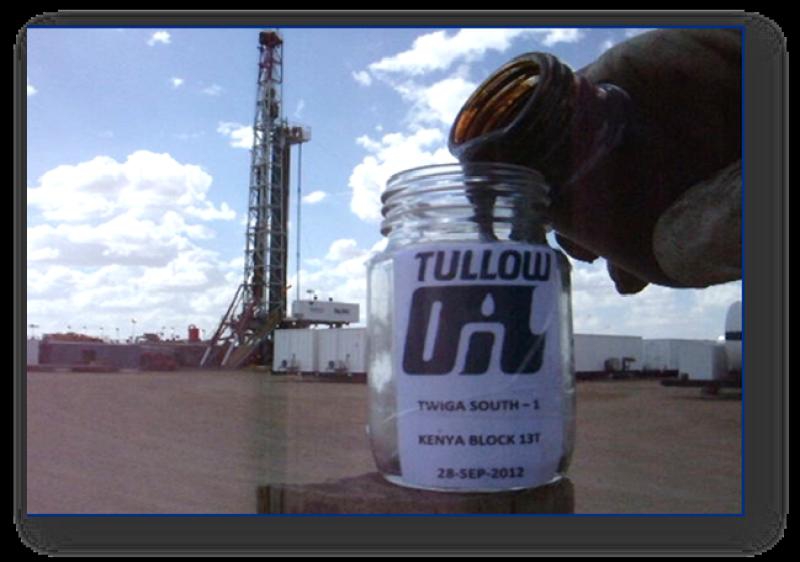

After several failed attempts at probing the expenditure of British firm Tullow Oil, the Kenyan government has finally identified an audit firm to look into the company’s bill.

Tullow will claim all expenses incurred since 2010 when the oil revenues start trickling in, which may substantially reduce the country’s earnings from the natural resource.