×

The Standard e-Paper

Join Thousands Daily

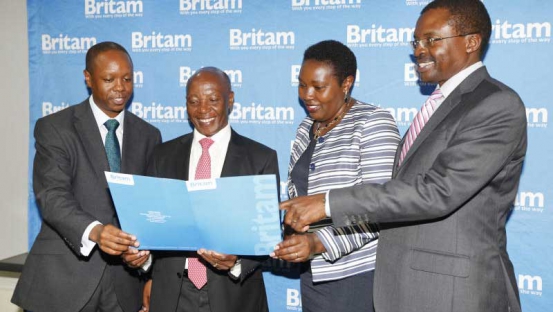

Ambassador Francis Muthaura has ended his four-year stint at the helm of financial services company Britam’s board.

The firm said on Thursday the career civil servant and Moi/Kibaki-era bureaucrat retired as the Chairman of Britam Holdings with effect from August 23 after attaining the mandatory retirement age of 70 years.