In Summary

- The biggest challenge facing the Government is raising cash to fund the many promises while avoiding excessive borrowing that is currently out of control.

- In its manifesto, Jubilee promises that it will create 1.3 million jobs annually, despite having not reaching the million jobs per year target promised in 2013.

- Institute of Certified Public Accountants of Kenya Chairman Julius Mwatu says Jubilee administration will at some point scale down on what is in the manifesto, owing to scarcity of resources.

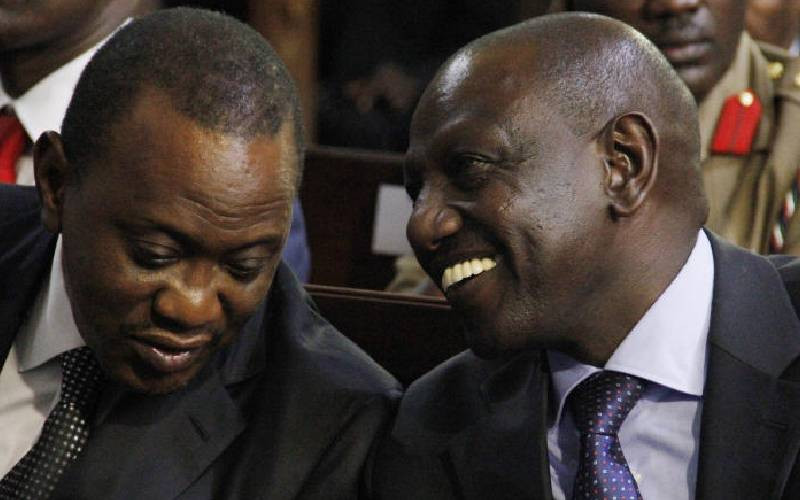

Politicians have over the last few months pulled all stops to woo voters. It was not any different with the UhuRuto duo.

The Jubilee Party honchos have made grand promises. In their party manifesto, the two leaders outdid themselves compared to the promises they made in their 2013 pitch for the highest office in the land.

The grand proclamations in their manifesto are despite the glaring failure to deliver on most of the promises made four years ago. Worse still, the two are silent on how they are going to finance such mega projects.

It is on the back of a populace that feels it is highly taxed and without accountability on utilisation of public funds. Debt levels have also narrowed the options of further borrowing for Kenya and the perception that there is no political goodwill to fight corruption.

In its manifesto, Jubilee promises that it will create 1.3 million jobs annually, despite having not reaching the million jobs per year target promised in 2013.

Jubilee has also said it will double the number of vulnerable Kenyans under the cash transfer programme to 1.4 million, build 57 large scale dams, construct 500,000 low-cost houses and increase its free maternity programme to include pre and post-natal care.

Tax revenues

These are just a few of the rosy ideas by the party that just got its second term in office, all of which combined might see the Government spend trillions of shillings in projects - money that is not freely available.

According to analysts, the Government will have the options of incurring more debt, growing tax revenues or bringing the private sector on board to finance some of the projects under Public Private Partnership (PPP) arrangements to achieve their mega plans.

All the available options of financing the projects will mean Kenyans taking a hit. There are even questions as to whether the projects are realistic, a priority and even whether some are necessary altogether.

Anzetse Were, a development economist, notes that while political parties had gone all out in detailing what they planned to do, none of them – including the Jubilee Party – had indicated how they would go about financing their grand plans.

Stay informed. Subscribe to our newsletter

She says there has been an obsession with mega projects that might not necessarily be adding much value to the economy and that Jubilee might have to scale down and zero in on what has meaningful impact on the economy.

“My main concern with the manifestos is that there is a lot of articulation of what they want to do, but little about how they are going to finance the projects,” she says. “The country has been investing heavily in projects but we have not seen the economy grow in line with the spending in infrastructure which would essentially mean that we are getting into debt that is not productive. The President may have to make some politically unpopular decisions.”

Gerrishon Ikiara, a senior economics lecturer at the University of Nairobi notes that as has been the case with manifestos in the past, the political parties might have gone overboard, making grand promises without putting much thoughts into how they would deliver them.

“The politicians have been over-generous with their promises and in some instances, there may not have been enough thought that went into them, especially measuring them against the resources that are available,” he says.

Scarce resources

Institute of Certified Public Accountants of Kenya Chairman Julius Mwatu says as the dust settles and the Government gets down to work, the Jubilee administration will at some point be forced to relook at the promises that they made and scale down on what is in the manifesto, owing to scarcity of resources.

“They will now have to sit down and look at what will be the priorities and will realise that some of the things contained in the manifesto are not realistic,” he says.

While tax revenues have been growing, the increase has not been in tandem with the expenditure and financing its promises could see the Jubilee Government get deeper in debt. Opinions are varied as to whether Kenya’s public debt is sustainable or not, and how much more it can afford to borrow. Public debt stands at over Sh4 trillion, which is over 50 per cent as a ratio of GDP. It has moved from under Sh2 trillion since Jubilee administration took the reigns in 2013.

Various lenders, including the World Bank and International Monetary Fund, have warned that Kenya has little wiggle room before it becomes unsustainable. The National Treasury, however, says the country’s debt is still manageable.

Canaan Capital Managing Director Rufus Mwanyasi notes that a mix of factors make it unwise for Kenya to continue on its borrowing spree, including the current debt levels, a looming hike in US interest rates and the fact that local borrowing might see continued decline in credit to the private sector from commercial banks.

This is as they increase lending to Government through Treasury bonds. “Although not quantified, from face-value, a number of the projects will require significant sums to execute. Does the Government have the money? It is not sufficient,” says Mwanyasi.

“Are we going to see more debt? Most likely. However, assuming wisdom prevails, this is not advisable. A ballooning budget deficit (7.5 per cent of GDP) does not allow this.”

He adds: “Over 60 per cent of external debt is dollar denominated, moving to unsustainable levels.” He further observes that it is unlikely that the Jubilee Government will effect tax increases, which would leave Kenya Revenue Authority with the task of coming up with other options of growing the tax base. “Our revenue collection has been growing, but it is not enough. Financing the gap has to be a balance so that you do not put the country in too much debt. Borrowing can bridge the gap, but the Government needs to be careful because debt financing has gone up and might be a challenge in the coming years,” he says.

“If it goes to high, then at some point in future, the repayments might become a bit heavy and have the impact of slowing down the economy. Taxes are unlikely to go above the normal. We are already highly taxed and I do not foresee any significant increases, if there will be any at all.”

The Government can, however, increase the taxation base, which would mean that the impact on the ordinary Kenyan would remain the same, but squeeze in a little more by having more taxpayers on board.

“KRA will have to evaluate modalities of doing this as it has not worked in the past,” he says.

The Government is also expected increasingly tap into the private sector to finance mega projects.

Private sector

This might mean Kenyans have to pay for use of projects as in the case of tolling roads or see bills for such essentials as water provision go up where private sector companies get into PPPs to build water projects.

“Resource gaps (both at national and county levels) makes PPPs the most efficient way. On a net-basis, PPPs are no more inexpensive, says Mr Mwanyasi.

“Because majority of government-funded projects are sub-contracted to private sector anyway - either way, the public pays. Furthermore, the private sector’s efficiency guarantees value for money. The biggest advantage of PPPs to the public may come in the form lower interest rates as government does not have to excessively borrow, effectively pushing the price of money and lower taxes.” Despite the huge opportunity for the private sector to finance public projects, there are concerns about the Government having inadequate capacity to negotiate and get the best deals out of them, which would have little strain for the country.

Miss Were, meanwhile, says both the national and county governments lack expertise to steer negotiations with private sector firms and get into agreements that are in the best interest for Kenyans.

In this case, she adds, there are chances that private sector officials would outmanoeuvre public officials and leave the Government with the short end of the stick.

“We do not have capacity and competency to negotiate the best deal for the taxpayer when it comes to getting into public private partnerships. There is need to build capacity at both the National and County Government levels otherwise we will not be getting the best deals,” says Were.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.