×

The Standard e-Paper

Home To Bold Columnists

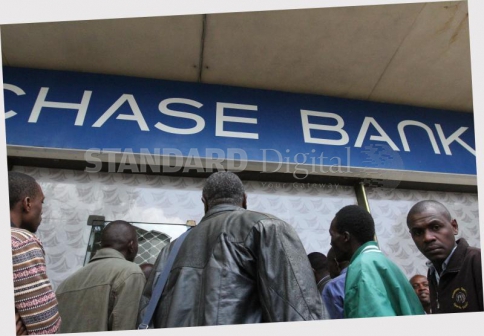

The multi-billion-shilling insider lending at the troubled Chase Bank left a trail of financial ruin across the country as thousands of account holders were blocked from accessing their money.

When the news of the bank being placed under receivership broke, desperate account holders – some of whom had skipped work or abandoned their businesses to salvage their deposits – were shocked to find that the bank was not operational.