×

The Standard e-Paper

Join Thousands Daily

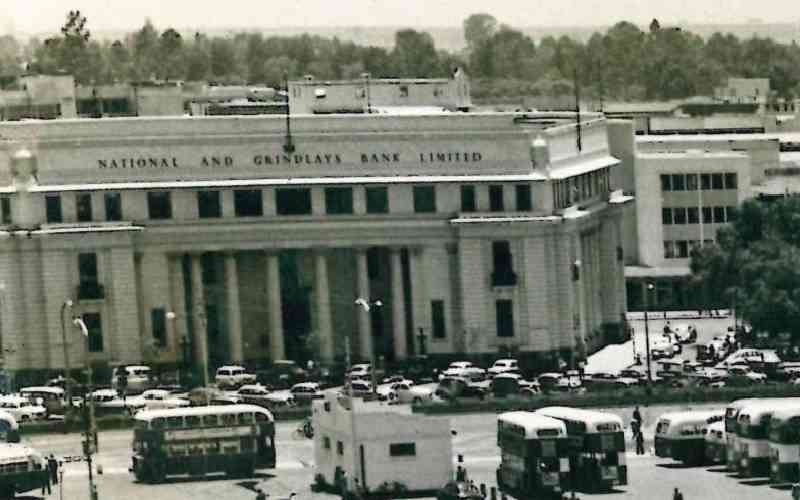

In the last 60 years, Kenya has been free from colonial oppression and domination. It has earned more than just political freedom. One of the most profound developments has been in the area of finance.

Gone are the days when a Kenyan had to know a bank worker or a reputable person to be allowed to open a bank account.