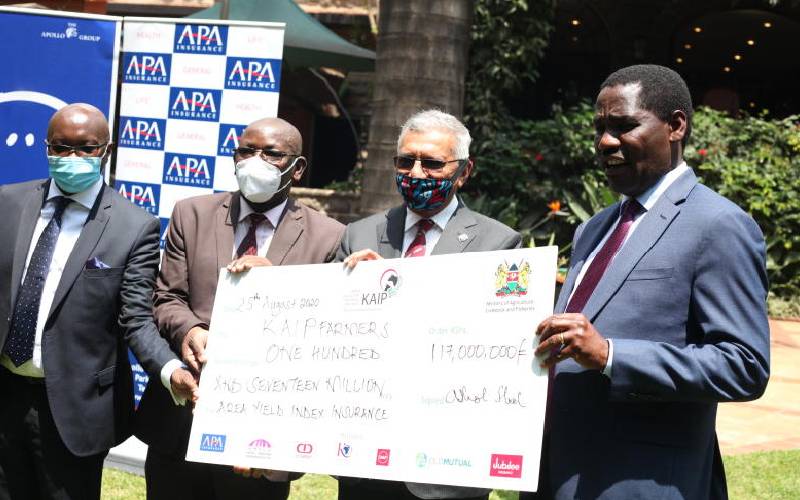

Agriculture Cabinet Secretary Peter Munya receives a cheque of Sh17 million from Ashok Shah (second right) from Apollo insurance. [File, Standard]

Insurers in Kenya are grappling with effects of Covid-19 amidst new capital adequacy requirements by the Insurance Regulatory Authority (IRA). IRA requires companies to meet 200 per cent (previously 100 per cent) of the Prescribed Capital Ratio (PCR). And while a good number of insurers were compliant by June 30, 2020, others had not. In a directive to all insurers, IRA requires submission of stress and scenario tests, including capital adequacy calculations and liquidity strains to determine the impact of Covid-19.