Just when you thought it was safe to go back to the fuel station or supermarket you are warned that another round of taxes are coming your way and that Kenya is going to borrow more and spend its way out of debt. The National Dialogue Forum (NDGI) had recommended that mega projects like the SGR from Naivasha to Malaba and the proposed Nairobi to Mombasa Highway be put on hold until such time as the debt burden eased and the country was in a position to feed itself. But Jubilee and its new friends have other ideas and are determined to leave a legacy by 2022.

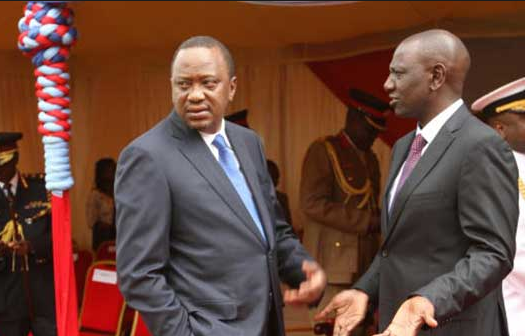

However, if we are to judge by the figures their legacy may well be just an unmanageable debt. Currently the national debt is Sh5.27 trillion and that is expected to rise to Sh7.17 trillion by 2022. More worrying still is that 80 per cent of that debt is incurred since Mr Kenyatta and Mr Ruto ascended to office in 2013. What have they achieved to justify such a huge national debt? If half of the taxes are used to service the debt then what will remain for development and devolution after the recurring expenditure is deducted?