×

The Standard e-Paper

Home To Bold Columnists

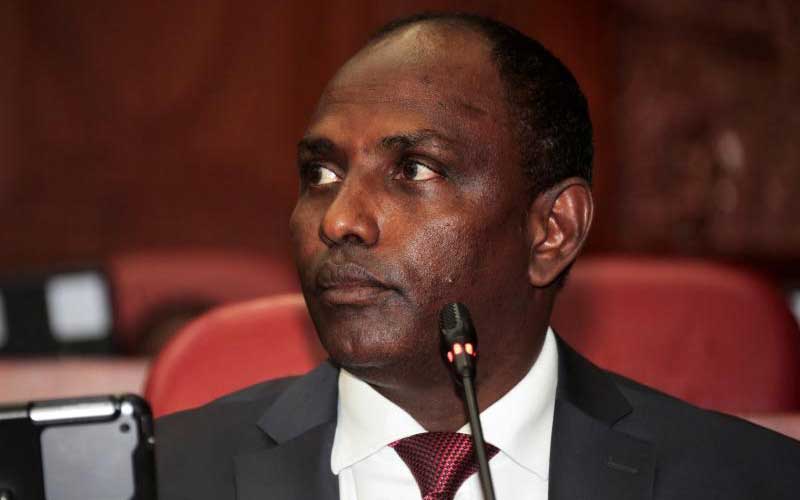

National Treasury CS Ukur Yatani. Treasury is mulling a mini-budget that may see deep spending cuts for ministries and departments as coronavirus hits the economy. [File, Standard]

National Treasury may present a mini-budget to address the impact of the deadly coronavirus.