×

The Standard e-Paper

Kenya’s Boldest Voice

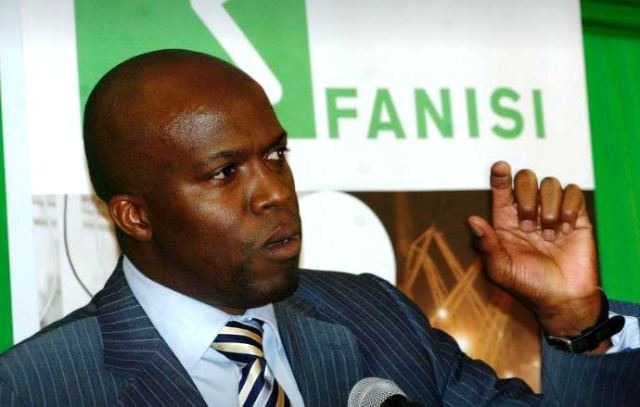

Fanisi Capital has reduced its fundraising target to the tune of Sh5 billion, even as it sets sight in Kitengela International School.

The firm was targeting to raise between Sh7.5 billion and Sh10 billion in the next one year - having locked down Sh3 billion in commitments from eight local pension schemes.