×

The Standard e-Paper

Home To Bold Columnists

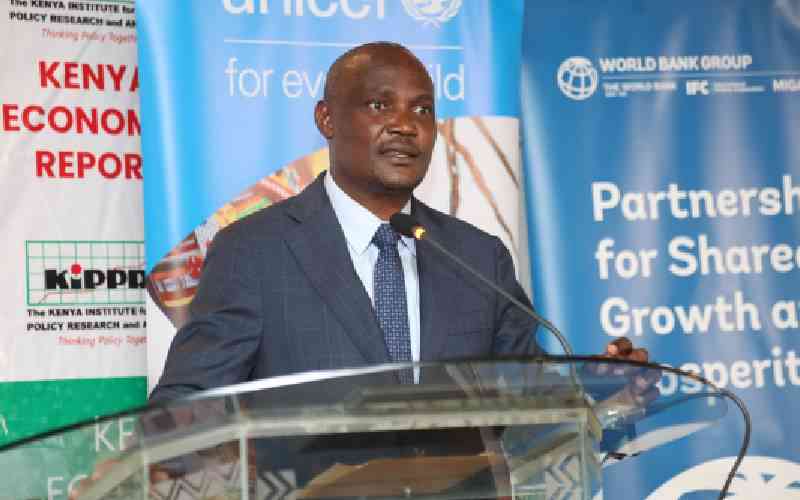

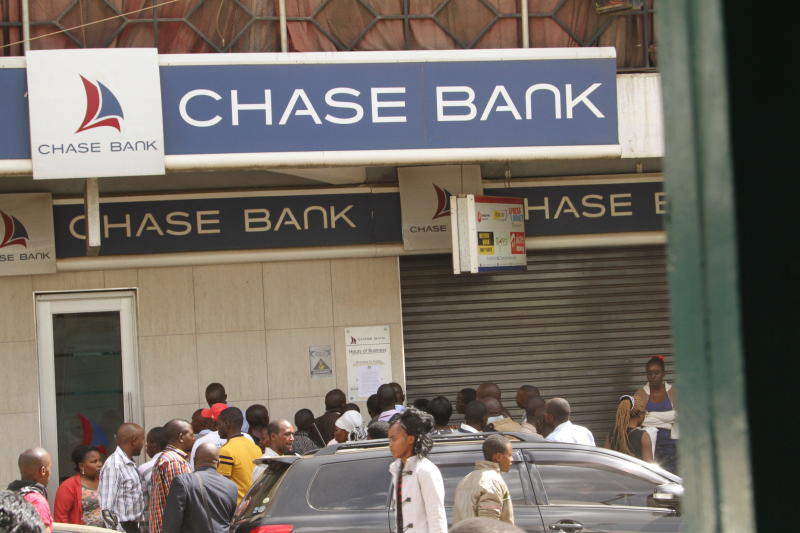

Treasury Cabinet Secretary Henry Rotich is the man who wields the power to veto or approve transfer of Chase Bank’s assets to the State Bank of Mauritius.

Despite the deal having been concluded and parties expecting it to close by Friday last week, the National Treasury has poured cold water invoking section 9 of the Banking Act that gives it the final say.