×

The Standard e-Paper

Kenya’s Boldest Voice

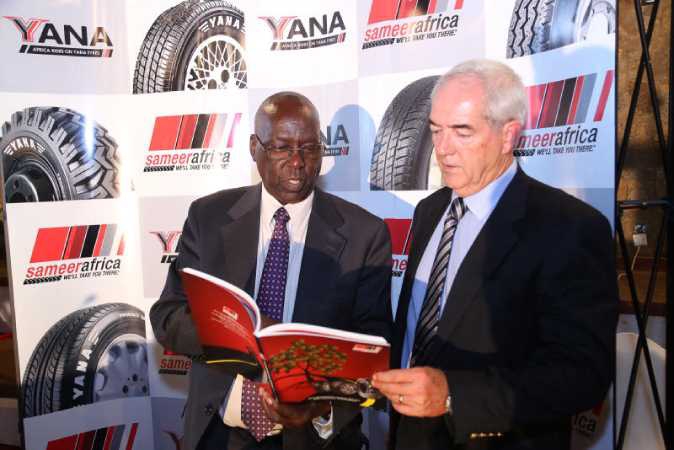

NAIROBI, KENYA: Sameer Africa is reviewing its presence in Tanzania, Uganda and Burundi, and may pull out of the loss-making markets.

The firm’s management says profits have been elusive in the three East African Community countries owing to a combination of negative factors overshadowing the group’s efforts to turn them around.