×

The Standard e-Paper

Join Thousands Daily

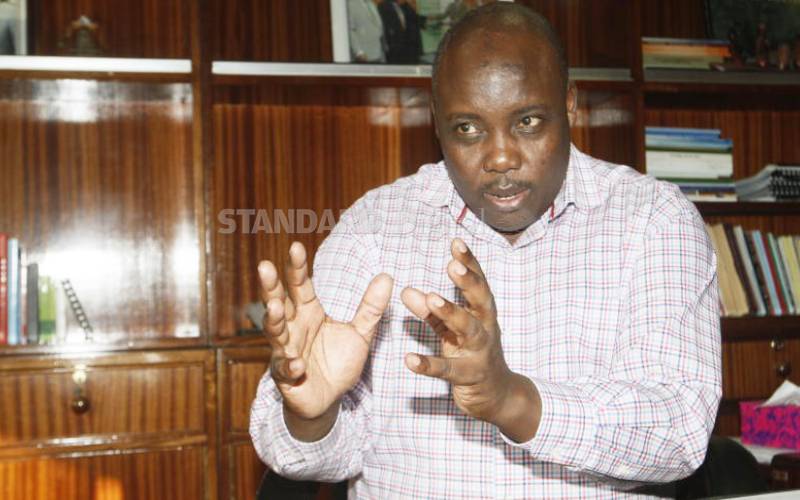

Higher Education Loans Board CEO Charles Ringera. He says new proposal will lock out thousands of students from Helb. [Jenipher Wachie, Standard]

An MP wants the interest charged on Higher Education Loans Board (Helb) loans reduced from four per cent to two per cent.