×

The Standard e-Paper

Join Thousands Daily

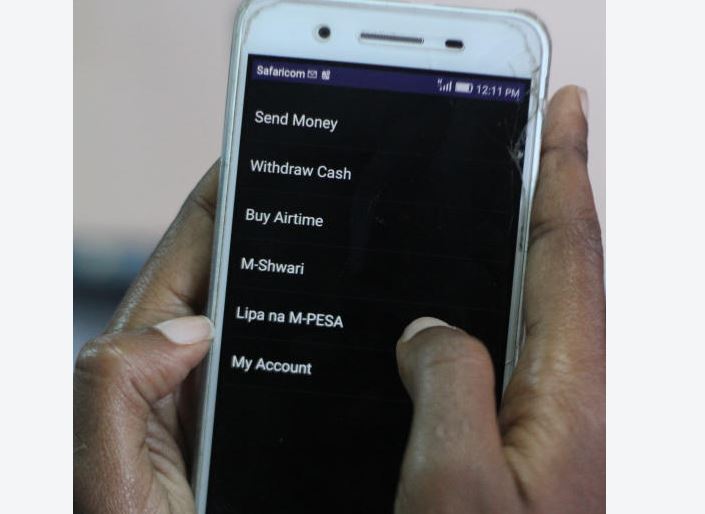

Mobile money transactions have declined in the wake of new taxes introduced on digital cash transfers and bank charges.

Data from the Kenya National Bureau of Statistics (KNBS) indicate that transactions marked one of the steepest declines in several months, both in the number and value of money sent.