×

The Standard e-Paper

Truth Without Fear

Kenyans are staring at tougher financial times if the Finance Bill, 2023, which proposes a flurry of new levies, if passed by Parliament.

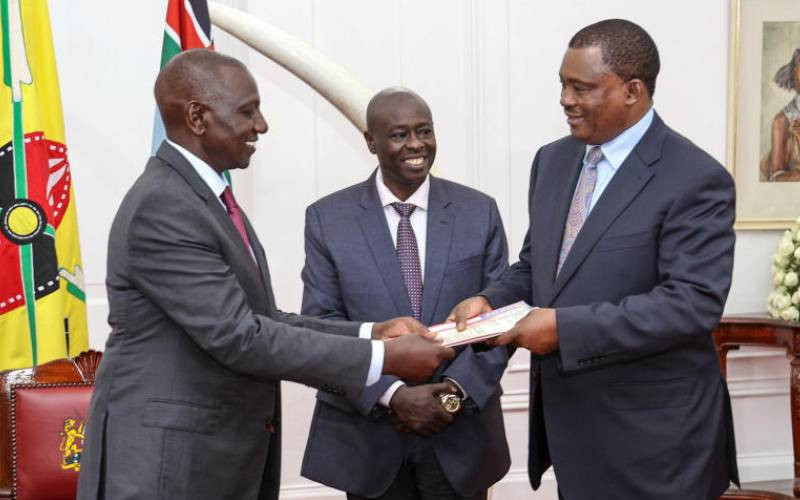

Amid a biting cost of living, President William Ruto's government proposes to increase VAT charged on fuel, which will lead to higher fuel, electricity and other commodities prices, even as the National Treasury proposes new deductions.