×

The Standard e-Paper

Fearless, Trusted News

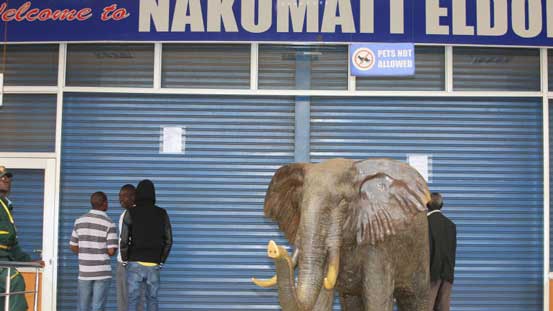

NAIROBI, KENYA: Landlords are frustrating Nakumatt’s turnaround strategy, with some resorting to disconnecting electricity in efforts to force the troubled retailer out of their premises.

Peter Kahi, the retailer’s court-appointed administrator, said in a new report that the landlords were engaging in “operational disruptions”, with some refusing to give the retailer access to their premises despite court orders to the contrary.