×

The Standard e-Paper

Smart Minds Choose Us

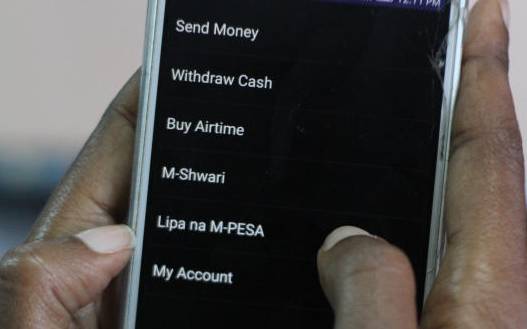

M-Pesa customers are projected to borrow up to Sh200 billion from the newly launched Fuliza service over the next year, giving Safaricom one of the biggest loan books in the country.

Analysts further expect Fuliza, an M-Pesa overdraft facility, to generate Sh21 billion in revenues over the same period, while netting two million new M-Pesa subscribers for Kenya’s largest telecommunications firm.