×

The Standard e-Paper

Kenya’s Boldest Voice

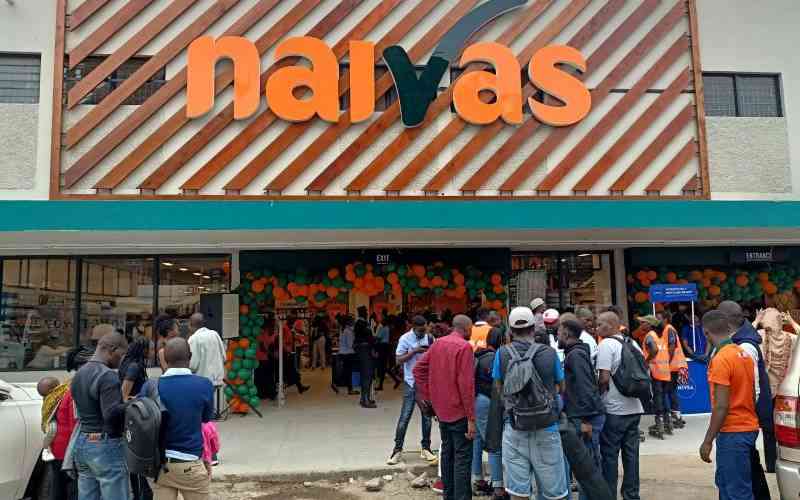

The family of Peter Mukuha - the founder of supermarket chain Naivas - is embroiled in a property row, with one of his daughters seeking to be named administrator.

Grace Wamboi wants the court to rectify a grant issued to her late brother Simon Gashwe .