Most African countries have a positive economic outlook, largely due to their diverse economies, according to the Institute of Chartered Accountants in England and Wales (ICAEW) latest report, Economic Insight: Africa Q2 2019.

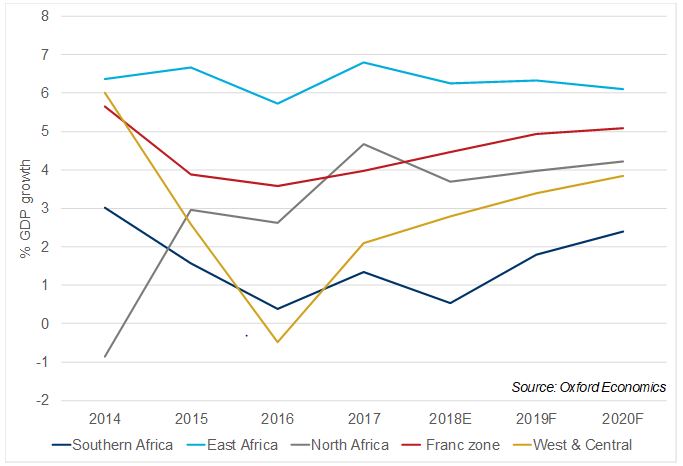

The accountancy body provides GDP growth forecasts for various regions including East Africa, which is the region in Africa that was estimated to have experienced the most rapid real GDP growth in 2018, and is forecast to continue doing so over the next two years, with a projected growth rate of 6.1 per cent.