×

The Standard e-Paper

Kenya’s Boldest Voice

Assets of at least eight State corporations risk seizure by lenders over Sh147.7 billion loan, Parliament warned yesterday.

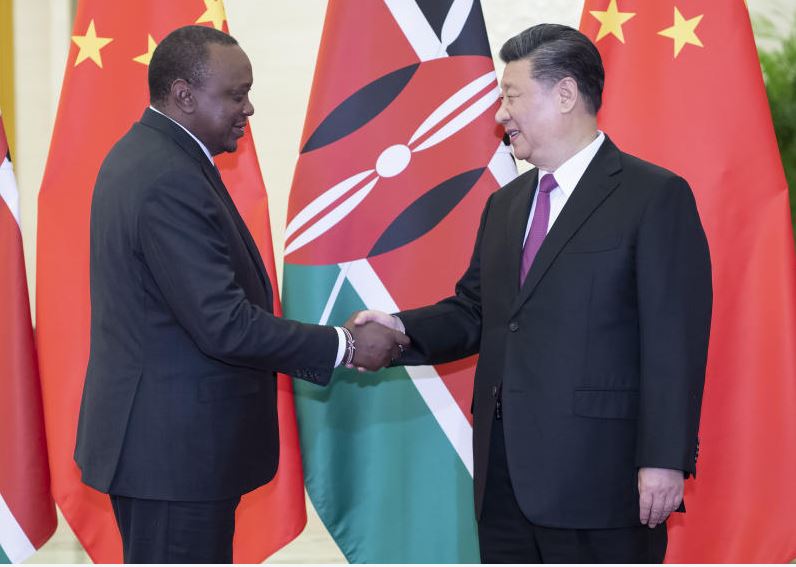

The warning came even as President Uhuru Kenyatta pitched for more loans in China, where he is on a three-day visit to seek Sh368 billion to finance the extension of the Standard Gauge Railway (SGR).