×

The Standard e-Paper

Kenya’s Boldest Voice

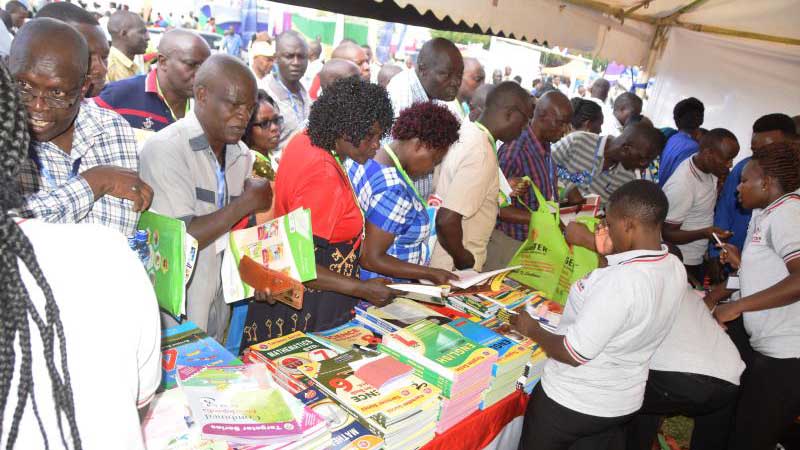

A man has for the second time petitioned legislators to remove the tax on textbooks to make them more affordable.

Njoroge Waweru, whose bid to have the 16 per cent value-added tax imposed on textbooks scrapped floundered in 2016, has returned to the National Assembly with the same petition.