×

The Standard e-Paper

Smart Minds Choose Us

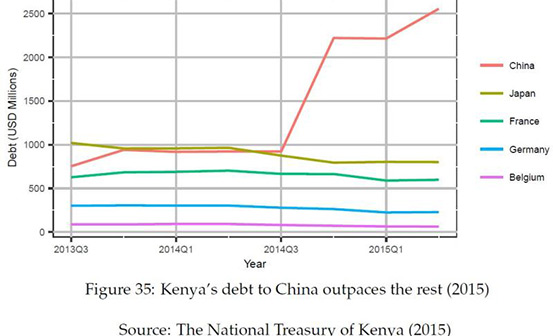

The World Bank has warned that Kenya’s level of borrowing from China could be close to unsustainable.

The caution from the US-based international lender that provides loans to developing countries, is contained in a policy paper on Kenya. “Kenya still has a heavy debt burden and China’s loans can bring debt to unsustainable levels,” the Bretton Woods Institution says of the country’s appetite for loans from the Asian economic giant.