Equity Bank has received Sh15 billion for onward lending to small and medium enterprises (SMEs) from the African Development Bank, in new credit lines expected to cement the region’s largest lender.

Equity Bank Chief Executive James Mwangi said the funds will be extended to entrepreneurs with micro to medium-sized businesses.

“This fund is to act as catalyst and facilitate transformation by increasing long-term funding required to allow micro, small and medium businesses to scale up and increase production” said Mwangi during the partnership signing.

“This support is regional in six countries where Equity Bank is operating. We want to ensure cross-border trade. Africa has to increase trade with itself. The structural and policy changes in the continent support this.”

The bank will provide the loans at ten per cent, which is about half the market rates. Equity Bank is the biggest lender in Kenya, on customer numbers, making up for about half of all the country’s bank accounts.

Mwangi said the bank is working with 619,000 enterprises of this 601,000 are micro-enterprises, 18,564 small businesses, 364 medium and 222 are large enterprises.

“We want in three years to have 50,000 micro-businesses become small businesses, then 10,000 small enterprises turned into medium businesses. This is where we need to put more emphasis. It is longevity of the availed fund that is significant” said the Equity Bank chief executive. AfDB’s credit line to Equity is projected to tackle what most entrepreneurs cite as the single biggest obstacle to doing business - high interest rates on bank loans.

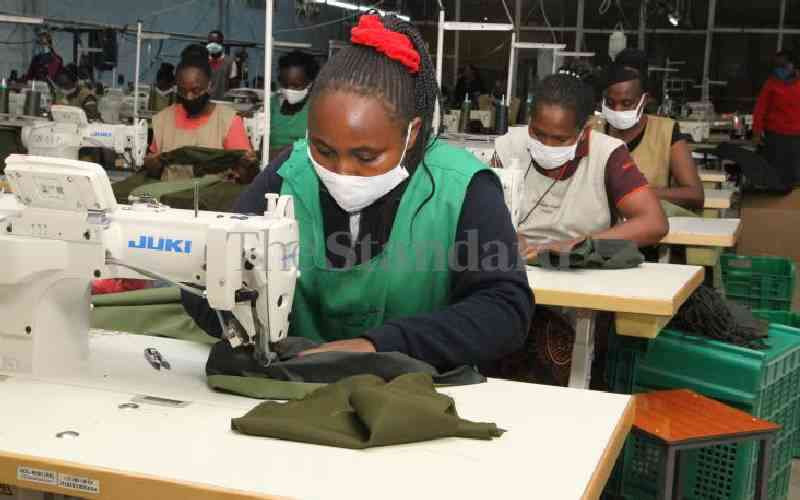

SMEs are Kenya’s mainstay, employing the bulk of the population. Mwangi said the loans will help modernise the economic activities of the entrepreneurs, adding that the facility will enhance its capacity to provide long-term loans of up to 15 years.

AfDB’s Director for the Eastern Africa Regional Resource Centre Gabriel Negatu said the loan to Equity will provide access to cheaper loans, both in Kenya and in the other countries that Equity has operations in. “We believe that SMEs are the backbone of the Kenyan economy.”

Financial resources

Negatu said the project aligns with structural transformational themes espoused in the 2013-2022 ten-year strategy of the bank. “These are innovators and business people who have the know-how, skills and capacity but lack financial resources to grow their businesses from micro to macro and from small to medium,” Negatu said.

Equity Bank boss noted that the facility focuses on value addition and scaling up of the production in the targeted enterprises, especially in the export-oriented enterprises. “Manufacturing goods in the region is open to a large market supported by the increasing infrastructure” said Mwangi.

Recently, Equity Bank signed asset financing deals with two leading commercial motor vehicle dealers - Hino Motors Kenya and Simba Colt Motors to provide attractive vehicle financing deals.

Equity Bank will be offering up to 95 per cent financing on Simba Colt Motors range of Mitsubishi Fuso trucks and buses. At Hino Kenya, the similarly tapped the firm to provide asset finance solutions for its Hino 300 and FC 500 models.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.