×

The Standard e-Paper

Fearless, Trusted News

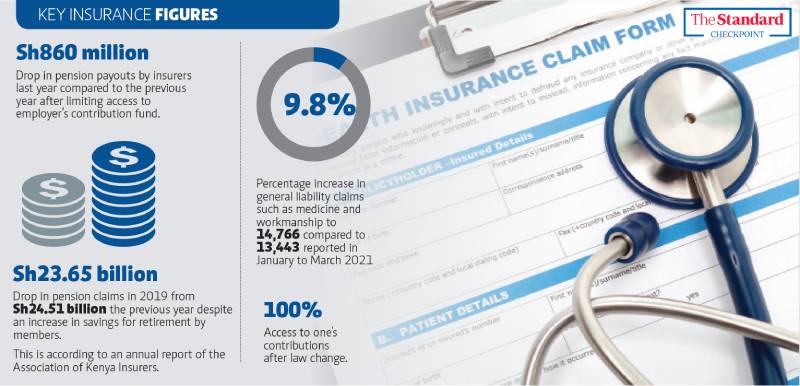

Kenyans hit hard by the Covid-19 pandemic raided their savings with non-liability insurance claims increasing by almost a fifth to two million between April and June.