×

The Standard e-Paper

Join Thousands Daily

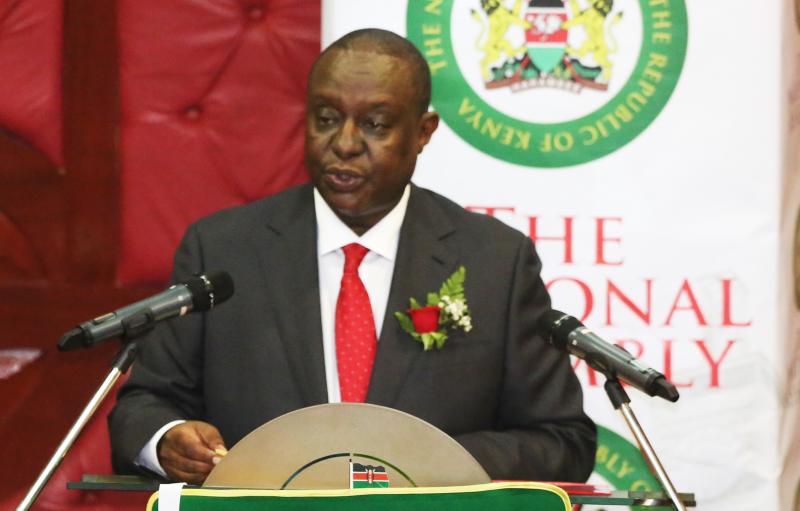

NAIROBI, KENYA: Treasury Secretary Henry Rotich has presented the 2019/20 budget in Parliament featuring new tax measures that pump extra Sh37 billion into the Exchequer.

On Pending Bills