President William Ruto has announced that Kenya will privatise key state-owned firms through initial public offerings (IPOs) at the Nairobi Securities Exchange (NSE) to attract local and foreign investment.

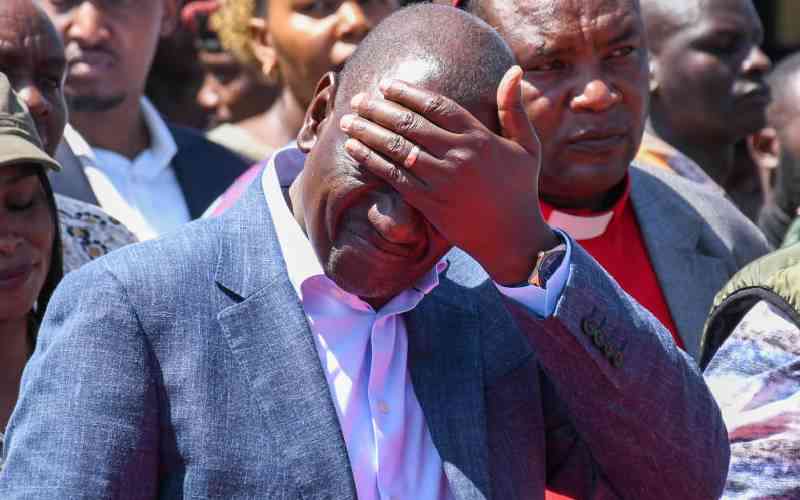

Ruto announced on Wednesday, July 2, during a symbolic bell-ringing ceremony at the London Stock Exchange (LSE), where he opened the trade market alongside African policymakers, investors, and development partners as part of the Africa Debate Forum.

“We have made a strategic decision to broaden Kenya’s stock market appeal by earmarking key state assets for privatisation through initial public offerings,” noted Ruto.

As part of this plan, Kenya plans to list the Kenya Pipeline Company (KPC) through an IPO in 2025 to attract strategic investment in infrastructure.

He explained the government will prepare a robust pipeline of assets for listing or private sector participation under a structured, time-sensitive programme.

Kenya is seeking to deepen domestic capital markets to help African countries cushion against volatile capital flows, attract investment, and finance long-term projects such as infrastructure and industrial growth, Ruto observed.

“Capital markets mobilise domestic savings, attract international capital, and finance infrastructure, innovation, and industrial transformation across Africa,” he explained.

Ruto noted Kenya’s capital market reforms, supported by fiscal consolidation, effective debt management, and a stronger currency, have positioned the NSE as Africa’s top performer in dollar returns in 2024, citing Morgan Stanley Capital International.

Across Africa, governments and regulators are working to expand product offerings and unlock the value of public assets through listings and private partnerships, he added.

Ruto praised the United Kingdom (UK) as a steadfast partner in advancing Africa’s capital markets, pointing to UK-backed initiatives such as Mobilist and Financial Sector Deepening Africa (FSD Africa) that promote financial inclusion, develop green and gender bonds, and integrate climate finance into markets.

Kenya is also working to expand capital access, particularly for small businesses and women entrepreneurs, and foster sustainable finance as a driver of growth, he noted.