×

The Standard e-Paper

Smart Minds Choose Us

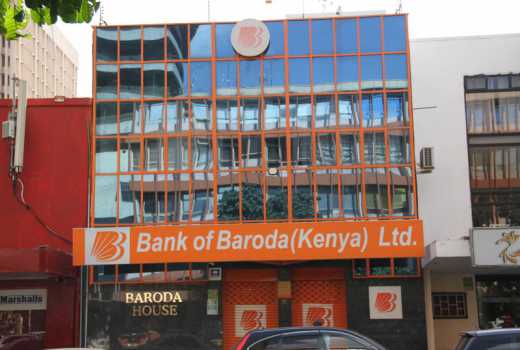

A group of almost 20 South African companies linked to the Gupta family have lost a court bid which sought to have India’s Bank of Baroda, the last lender doing business with the firms, maintain operations in the country, court documents showed yesterday.

Baroda’s South African division was thrust into the spotlight two years ago when it agreed to take on the Guptas after South Africa’s major banks turned their back on the family’s businesses.