×

The Standard e-Paper

Fearless, Trusted News

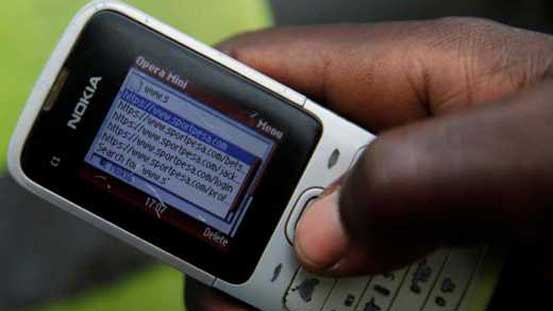

NAIROBI, KENYA: Cards and cash are not the only way to make payments. Particularly in a growing online world, new ways to quickly and safely transfer money are being developed all the time.