×

The Standard e-Paper

Stay Informed, Even Offline

Rift Valley Railways (RVR) was incapable of running the Meter Gauge Railway (MGR), Kenya has told a London court.

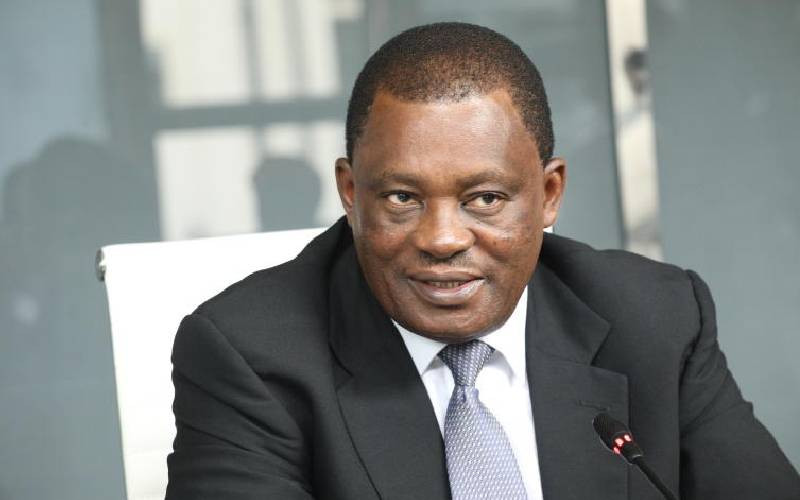

In its statement presented by Attorney General Justin Muturi, former AG Prof Githu Muigai and King's counsel Michael Sullivan, Kenya told the London Court of Arbitration that the firm actually led to the dilapidation of the infrastructure.