×

The Standard e-Paper

Truth Without Fear

A third suspect linked to an alleged elaborate fraud and money-laundering ring involving more than USD 800,000 (Sh103 million) has been charged at the Kahawa Law Courts, deepening a case that prosecutors say was executed through a well-coordinated criminal network spanning several months.

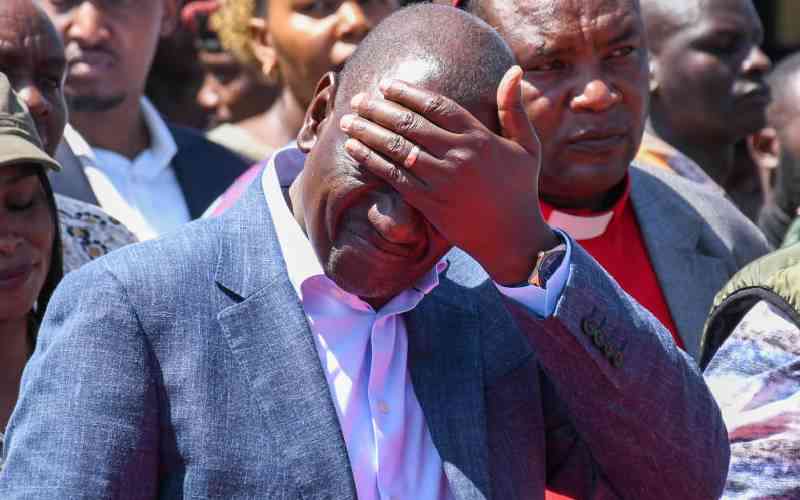

Lawyer Stephen Juma Ndeda was on Monday arraigned before Senior Principal Magistrate Richard Koech, where he faced five counts ranging from conspiracy to defraud to engaging in organised criminal activities.