×

The Standard e-Paper

Smart Minds Choose Us

Kenya is in a deep financial hole. The country is in a place it has not been for the last 60 years. And as financial experts and policy makers agonise how to extricate the country from the current mess where even paying workers' salaries and servicing debts is a nightmare, a glance into the past offers some perspectives.

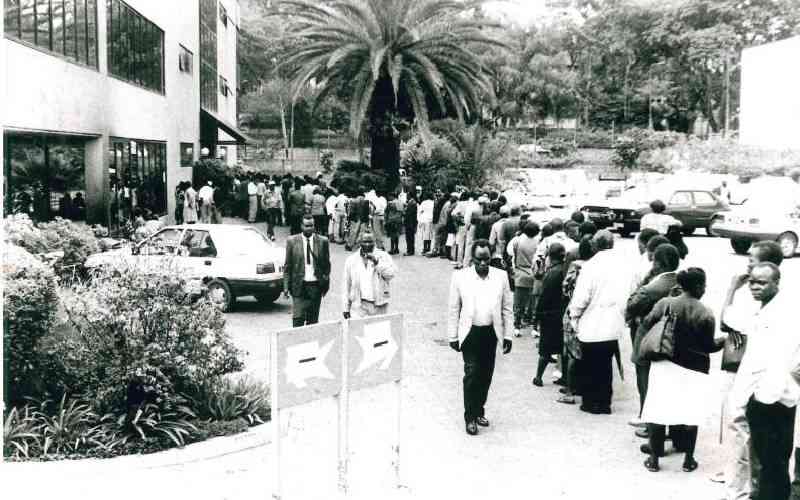

This was in 1993 when banks went bankrupt, the government was forced to liquidate some, while auditors developed ulcers and top bank managers were forced out of office.