×

The Standard e-Paper

Join Thousands Daily

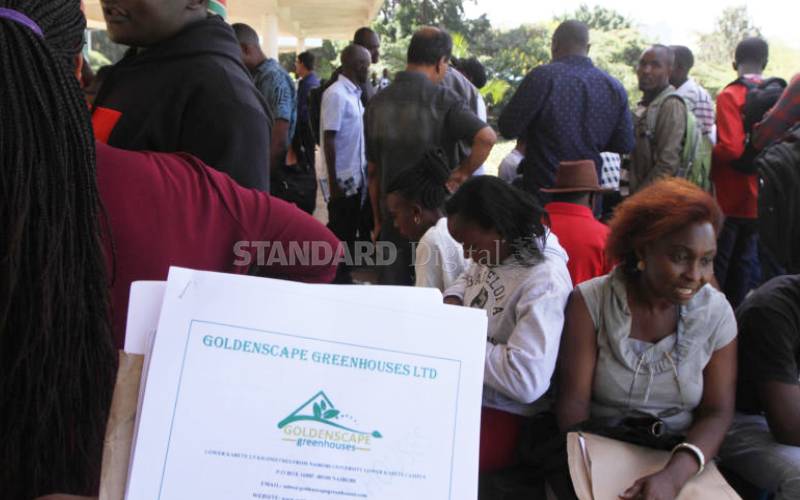

Investors gather at Uhuru Park, Nairobi to plot next course of action after they were conned by Goldenscape Greenhouse Ltd. [Elvis Ogina, Standard]

Thousands of gullible investors have been duped into get-rich-quick agribusiness schemes that have turned into mega frauds where they lost billions.