×

The Standard e-Paper

Join Thousands Daily

Kakamega County Assembly cannot account for millions of shillings out of the Sh899.9 million shillings it received for the year ending June 30, 2017, the Auditor General has said.

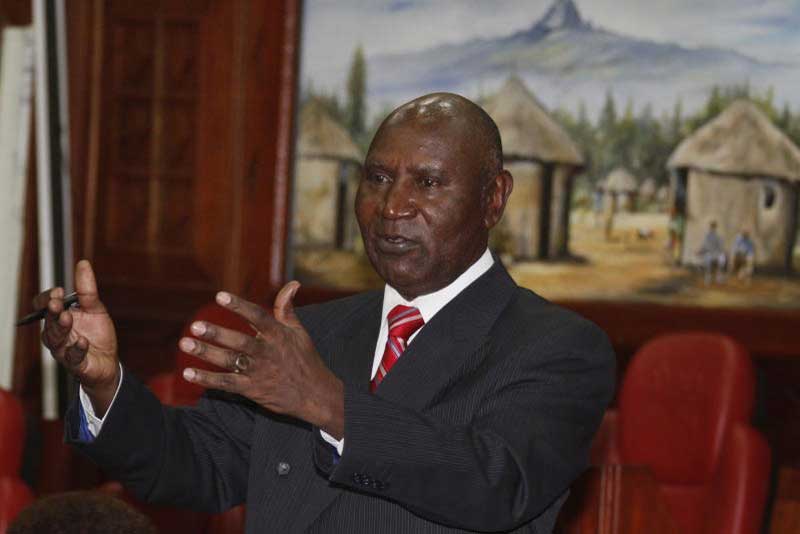

According to Edward Ouko, there were inaccuracies in financial statements submitted by the county assembly.