|

|

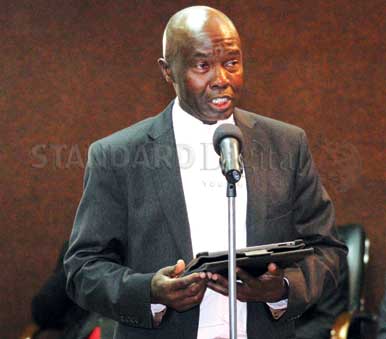

Kepsa chairman Obath; The private sector is worried that VAT refunds are rising by Sh1.5b monthly. |

By James Anyanzwa

NAIROBI; KENYA: The private sector has hit out at the Kenya Revenue Authority (KRA) over the rising volumes of unpaid Value Added Tax (VAT) refunds.

The amount is estimated at billions of shillings. The lobby wants the accrued amount to earn interest. Kepsa accuses the taxman of applying double standards in the treatment of taxpayers.

The members, through their umbrella body Kenya Private Sector Alliance (Kepsa), said while businesses that delay in remitting of taxes to KRA are liable for punishment, there is no such compensation for refunds to businesses from KRA.

Punitive measures

The punishment includes high interest charges on the amount outstanding compounded on a monthly basis. “It is important to have a reciprocal treatment to the taxpayer whereby any amount of money owed to taxpayers by KRA not paid within 30 days after the lodging of the claim should attract equivalent interest and penalties,” said Patrick Obath, Kepsa chairman.

“This will compensate the claimant in case of delays, provide businesses with certainty and assist in cash flow planning of the business. It will also create trust between KRA and the taxpayer and encourage people to be more compliant because of a fair environment.”

The private sector reckons that KRA is holding in excess of Sh25 billion of unpaid VAT refunds, which are rising by about Sh1.5 billion monthly.

Kepsa says these refunds relate to companies that supply withholding VAT agents or make zero-rated supplies. Consequently, these companies are continuously in a VAT refund position. They thus suffer additional burden in terms of cost and time in submitting and pursuing VAT refunds from KRA.

The delays in payment of the refunds have become a major cash flow challenge in business operations. “Capital that would have been invested in productive ventures is strained, which hampers growth and profitability. Tax payers are increasingly feeling like they are being punished even where they are compliant,” said Obath.

Kepsa also requires some provisions that allow taxpayers to offset any VAT refundable against its other taxes such as withholding tax, Pay As You Earn and corporate tax without recourse to the taxman.

Kepsa says the inefficiency in obtaining refunds from KRA means that affected businesses have to finance the VAT out of cash generated from operations.

Some, it argues, have to arrange additional working capital by borrowing from commercial banks. This increases their business and interest costs. Though scarcity of funds has been the major obstacle to prompt payment of VAT refunds, Kepsa noted that the requirement that all VAT claims be audited, validated and vetted has also slowed down the process. It is argued that audits tend to take longer than anticipated and in some instances audits have proceeded years without conclusion.

“When follow up is made, the taxpayers have had to contend with additional requests for information, even when it has been stated that the information requested is not available. There is need to cap the time frame for audit to a specific period to avoid endless audit,” said Obath.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.